Rapid 2022 Review

More Materials, More Machines and, some Software

Every time I attend a trade show like Rapid TCT I like to do a quick walk of the hall taking in as much information as quickly as possible, looking for trends, outliers, and making a note of where to go back and learn more if there is something interesting before I get too dehydrated and distracted.

This year was much the same but I did force myself to be a little more open minded as Fortify had asked me to guest post about Rapid this year which was great, because it made me delve a little deeper into materials, here is the opening, the rest can be read on their site.

While visiting an event like Rapid + TCT it is easy to see the messaging writ large at many of the booths with ‘machines 100 times faster’ (than what? must have been in the small print somewhere) or ‘20% more build volume’ (ok?) and materials that are ‘twice as strong’ or ‘twice as light’.

The really interesting developments aren’t always shouted out as bold typeface booth graphics are a little more nuanced, often application-specific, and well, are material properties.

The material properties that have evolved over the past few years have made additive manufacturing capable of highly performant components for both manufacturing aids and end-use applications.

The increase in speed of machines and larger build volumes can open up more potential business applications for additive manufacturing, however, it is often the material properties that really seal the deal.

What I did not call out in the article was how small the software representation at the show was in 2022.

Sure, every hardware company that exhibited can claim they also create software to varying degrees to ensure a geometry can be consumed and converted to some form of G-code to manufacture a part but actual software as core focus was pretty limited compared to the number of hardware and material companies at the show.

What software companies were at Rapid 2022?

There were a few print preparation and execution software companies present such as Materialise, Dyndrite and Oqton, which makes sense for both end users, and maybe more importantly for potential partnerships with hardware companies.

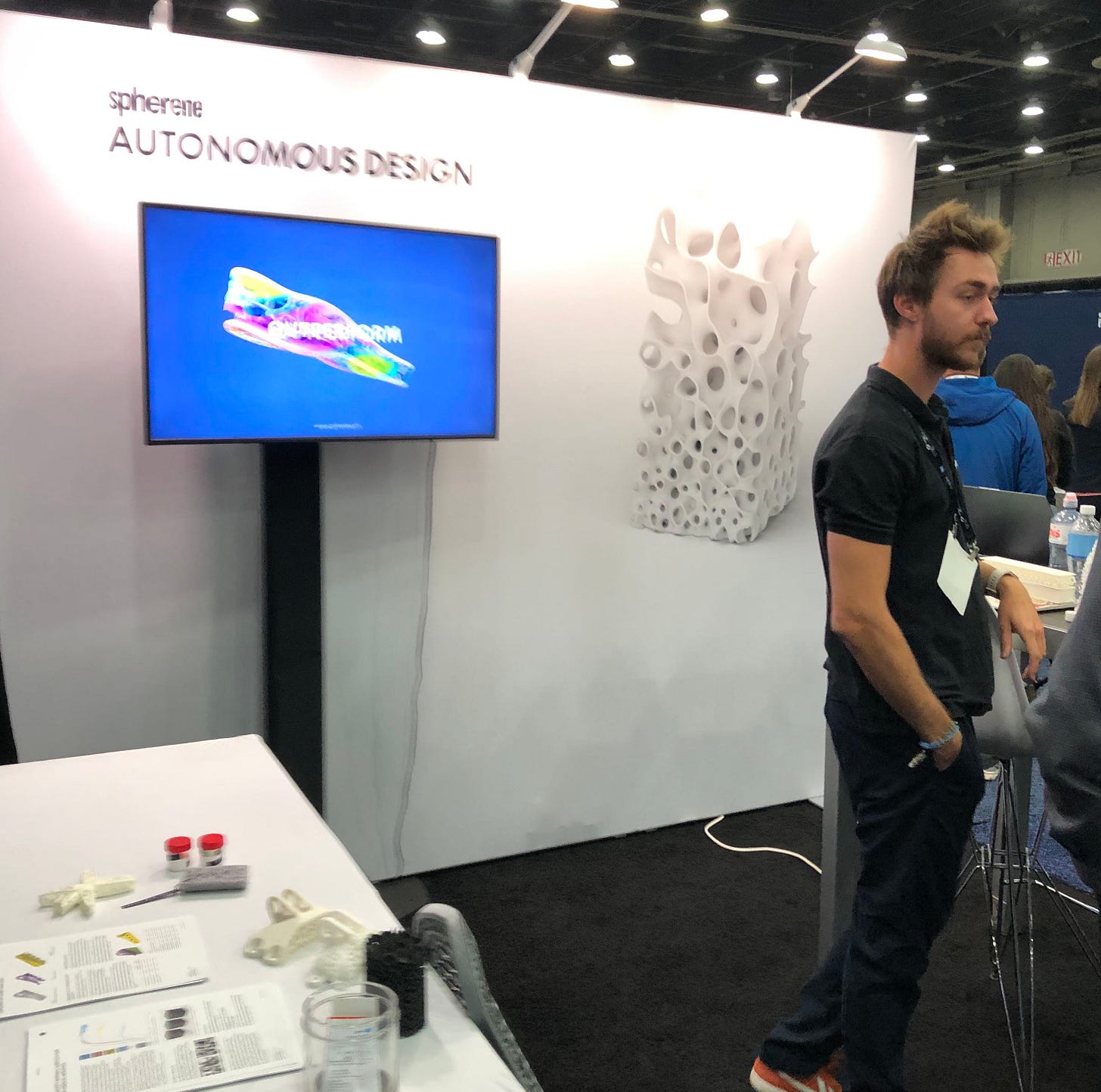

There were a few DfAM and/or lattice software companies present such as Spherene, General Lattice, nTopology and Altair.

And there were some simulation companies such as Additive Lab, Hexagon and ANSYS.

Larger CAD companies including Autodesk, PTC, Dassault were either absent from the event, or were collaborating to expose their software, or the results of it on their partners booth with only Siemens investing in both a booth and speaking sessions including Siemens USA CEO & President Barbera Humpton.

That gives us 10 software exhibitors out of 381 at Rapid TCT in 2022.

If we think of any digital manufacturing process it typically requires a design, developed in software, communicated to a machine, via software to then cut, weld, bend, mold, modify a material.

To advance manufacturing we need to develop machines, material and software in tandem to ensure we can communicate design intent based on a known process and material properties to make anything of value. We of course also need people who understand all of these processes along with development of the business case, but more on that in another post.

There were as mentioned previously a number of presentations in the agenda that had DfAM and software elements which does help to call out the importance software plays in the equation.

What does it mean to have limited software presence at an advanced manufacturing conference?

Maybe everything is ok, this is all we need to cover the design, simulation, preparation and validation of advanced manufacturing.

Maybe there are too many hardware and materials companies closely replicating each other and there is a need for consolidation then things will balance out.

Maybe the larger software companies are still not sending their employees to conferences for fear of exposure to Covid or they see events not being of value.

Maybe the cost of exhibiting is prohibitive for the smaller companies and startups who may not be able to afford to send people and invest in the space to display their software.

Broader manufacturing is currently doing everything they can to be part of Industry 4.0, to digitize their processes, to automate manual tasks and consolidate their supply chain where in additive/digital manufacturing this is core to almost every aspect already. Many look to additive manufacturing as leaders in the field due to the digital thread inherent (though not always well woven) in the process.

We need to make sure we do not let the software side of advanced manufacturing lag or stagnate due to lack of investment, awareness and education.

I am not talking about VC investment, but the investment of time and energy for software companies to be present, engage and educate the benefits to the design and manufacturing engineers, and their bosses.

For software marketing teams it is not easy to always track the true return on investment of participating in an event. Hardware is a little simpler and traceable, a couple of sales can cover the cost of participation.

For engineers it is critical to be exposed to the latest software innovation that could help solve and engineering problem and make the business case for a particular process to be financially viable. Some of this can of course be achieved through online research, social networks such as Linkedin, Facebook and Reddit, but it is much faster to drill down on problems and solutions in person to get more nuanced understanding of what is possible.

Machines and Materials at Rapid 2022

There were also machines and materials at Rapid 2022.

The machines were either bigger and faster or smaller.

The materials were stronger and lighter.